What to look for when opening a bank account for a baby

One in two Australian babies have their own bank account, so what do parents need to know about setting one up?

Kate Browne is the managing editor at Finder.com.au and she spoke with Feed Play Love’s Shevonne Hunt about the ins and outs of baby banking and why parents are choosing to create accounts that are just for their kids.

How to open an account for your baby or child

“It’s separate from your account. It’s not going to get absorbed in your mortgage or your savings or whatever,” Kate said. “So when your child turns 18 they have some savings of their own … when they’re ready to start adulting.”

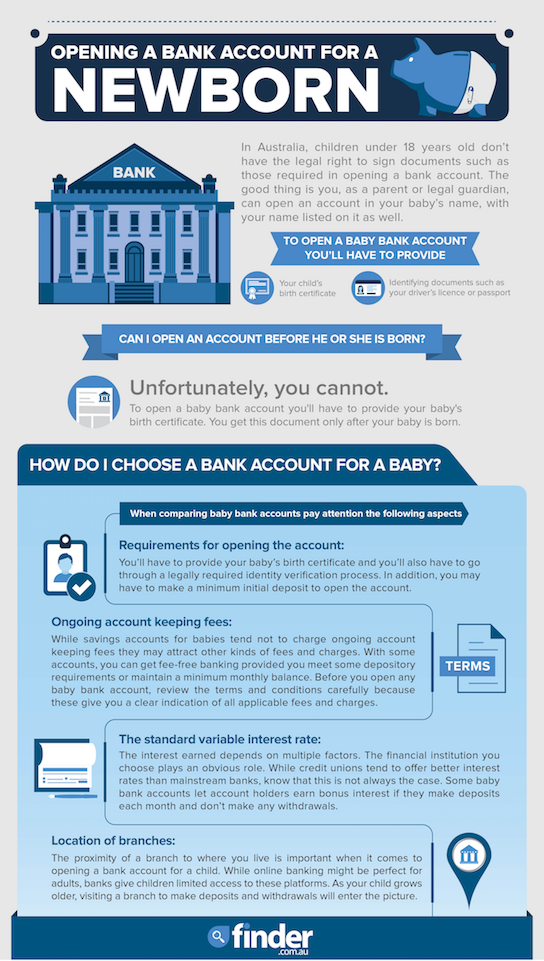

A parent or legal guardian can open an account in their baby’s name, with their own name listed on the account as well.

Your baby’s birth certificate plus your own 100 points of ID are required to create an account. You can’t open a bank account in your child’s name before they are born.

Read more stories from Feed Play Love:

- Intimate book shows how to love your body

- What to do when kids start saying they’re fat

- The truth about vaginal birth

Start early

Setting up an account when your child is very young is a brilliant idea. Not only does it set a brilliant intention to save for the future, but it also means they have plenty of years to accrue savings and make the most of the benefits of a children’s bank account.

Listen to Kate Browne on Feed Play Love

Choose a children’s bank account

Speaking of which, it’s important to choose a children’s bank account rather than the sort of everyday savings account that is designed for adults. Kids accounts are geared to savings rather than frequent transactions, so they have benefits built in that maximise kids’ savings. They don’t tend to charge an account-keeping fee and often offer bonus interest as well.

BankWest, the Commonwealth Bank, Suncorp, Bendigo Bank, all offer accounts specifically designed for littlies. You can compare their rates and restrictions at Finder.com.au.

Examine restrictions and fees closely

Kids’ accounts may come with some depository requirements. They may also have restrictions on withdrawals because they’re really designed to be a place for kids to ‘park’ savings for the long term.

“Unlike adults or even teenagers where we’re doing a lot of withdrawing of money … they’re designed for a kind of regular input and very minor kind of withdrawal,” Kate says. “They don’t tend to come with a debit card.”

Reap the rewards

Having a bank account is an excellent way to help your child get a grasp on money.

It teaches kids some early lessons in financial literacy, Kate says. “Having that separate account is going to give them that accountability. They can watch it grow, and hopefully learn how finance works.”

That seems like a brilliant idea to us!